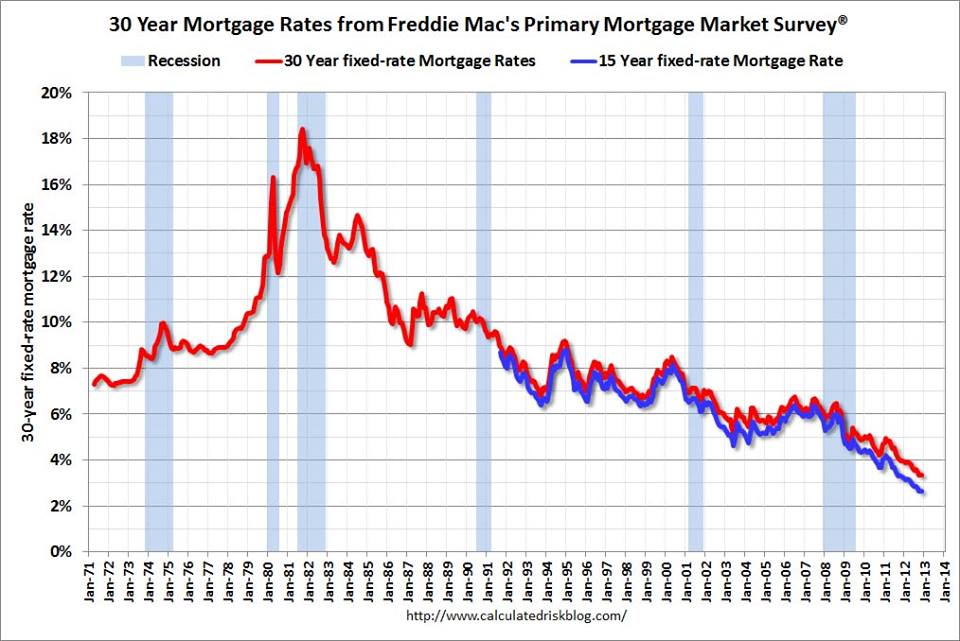

Why Mortgage Rates Fluctuate Mortgage interest rates fluctuate a bit differently than other, shorter term consumer loan rates. Credit cards, personal and auto loans typically fluctuate with lender cost of funds and prevailing short-term market rates. Mortgage rates change with the national economy strength or weakness, economic forecasts, Federal Reserve controls of the money supply Read more ›

Why Mortgage Rates Fluctuate

- box home loans,

- box rates,

- economic growth,

- fed,

- fed adjusts rates,

- fed and money supply,

- federal reserve,

- lender competition,

- lenders,

- libor,

- long term economic growth,

- long term rates,

- market forecasts,

- money circulation,

- money policy,

- mortgage interest rates,

- mortgage lenders,

- mortgage rates,

- rate predictions,

- rates,

- rates in the future,

- short term rates,

- stay ahead of the curve,

- todays rates,

- why are interest rates always changing,

- why do rates change,

- why mortgage rates fluctuate